The banking industry, once synonymous with traditional roles like tellers and loan officers, is undergoing a seismic transformation. Today, the coolest jobs in tech are increasingly found within banks and financial institutions. This shift is driven by the rapid adoption of cutting-edge technologies such as artificial intelligence (AI), cloud computing, and blockchain, which are reshaping the financial landscape. As banks evolve into tech-driven enterprises, the demand for skilled technologists is skyrocketing, creating a new frontier of opportunities for professionals in the field.

The Upward Trend of Tech Jobs in Banking

1. Banks as Tech Companies

Banks are no longer just financial institutions; they are becoming technology companies in their own right. According to McKinsey, nearly every activity in modern banking is powered by digital applications, advanced analytics, or automation. This transformation has led to a surge in demand for tech talent, with roles ranging from software engineers and data scientists to AI specialists and cybersecurity experts.

For instance, J.P. Morgan, one of the largest banks in the world, now employs over 50,000 technologists, making up nearly 20% of its workforce. The bank refers to its tech team as “engineers” rather than IT staff, reflecting its shift toward a tech-first approach. J.P. Morgan invests $15 billion annually in technology, focusing on areas like AI, cloud computing, and blockchain.

This transformation has created thousands of high-paying tech jobs, from software engineers to data scientists. This trend is not limited to large banks; even mid-sized and regional banks are investing heavily in tech talent to stay competitive.

2. Generative AI: A Game-Changer

Generative AI is one of the most transformative technologies in banking today. Banks are leveraging AI to enhance customer experiences, streamline operations, and drive revenue growth. For example, AI-powered chatbots and virtual assistants are revolutionizing customer service, while AI-driven analytics are enabling hyper-personalized financial advice.

Wells Fargo has developed a virtual assistant named Fargo, powered by Google’s Dialogflow and PaLM 2 large language models (LLMs). Fargo handles over 20 million interactions annually, assisting customers with tasks like bill payments, fund transfers, and transaction inquiries.

Additionally, Wells Fargo uses AI to detect fraudulent transactions, leveraging machine learning to analyze patterns and flag suspicious activities in real-time. Accenture estimates that generative AI could boost productivity in banking by 22-30% and increase revenue by 6% within three years. This has led to a surge in demand for AI specialists, prompt engineers, and data scientists who can harness the power of AI to drive innovation.

3. The Cloud-First Approach

Cloud computing is another key driver of tech jobs in banking. As banks move away from legacy systems and embrace cloud-based infrastructure, they are creating new roles focused on cloud architecture, DevOps, and cybersecurity. The cloud enables banks to scale rapidly, deploy new applications faster, and improve operational efficiency.

For example, leading banks are adopting multi-cloud strategies to avoid vendor lock-in and optimize costs. This shift has created a demand for cloud engineers, platform architects, and IT security specialists who can navigate the complexities of cloud migration and management.

Goldman Sachs has partnered with Amazon Web Services (AWS) to migrate its core banking operations to the cloud. This move has enabled the bank to scale its services, reduce costs, and improve operational efficiency. The project has created hundreds of jobs for cloud architects, DevOps engineers, and cybersecurity specialists.

Key Tech Roles in Banking

1. AI and Machine Learning Specialists

AI and machine learning are at the forefront of banking innovation. These technologies are being used for fraud detection, risk management, customer segmentation, and personalized marketing. Banks are hiring AI specialists to develop and deploy machine learning models that can analyze vast amounts of data and generate actionable insights.

2. Cybersecurity Experts

With the rise of digital banking, cybersecurity has become a top priority for financial institutions. Banks are investing heavily in cybersecurity talent to protect sensitive customer data and prevent cyberattacks. Roles in this field include security analysts, ethical hackers, and incident response specialists.

3. Data Scientists and Analysts

Data is the lifeblood of modern banking. Data scientists and analysts play a crucial role in extracting insights from customer data, optimizing pricing strategies, and improving decision-making. Banks are also using advanced analytics to predict customer behavior and identify new revenue opportunities.

4. Blockchain Developers

Blockchain technology is gaining traction in banking, particularly for cross-border payments and smart contracts. Banks are hiring blockchain developers to build secure, decentralized systems that can streamline transactions and reduce costs.

5. Cloud Engineers and Architects

As banks transition to cloud-based infrastructure, the demand for cloud engineers and architects is growing. These professionals are responsible for designing and managing cloud platforms, ensuring scalability, security, and compliance.

Challenges and Opportunities

1. The Talent Gap

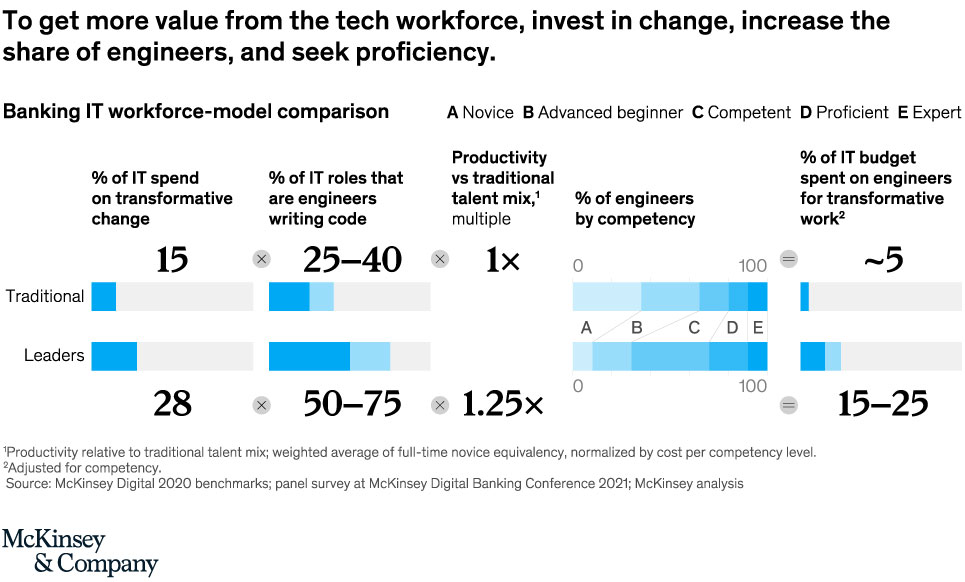

Despite the growing demand for tech talent, banks face a significant skills gap. According to McKinsey, only 10% of engineers in the banking sector are considered experts, while 60-65% fall into the novice or advanced-beginner category. This has led to intense competition for top talent, with banks offering competitive salaries, flexible work arrangements, and opportunities for career growth.

2. Upskilling and Reskilling

To bridge the talent gap, banks are investing in upskilling and reskilling programs. For example, OCBC Bank in Singapore has implemented AI training programs for its employees, resulting in a 50% increase in productivity. Similarly, leading banks are partnering with universities and tech companies to develop specialized training programs for emerging technologies like AI and blockchain.

3. Cultural Shift

The rise of tech jobs in banking is also driving a cultural shift within the industry. Banks are moving away from hierarchical structures and adopting agile, product-centric models that encourage collaboration between tech and business teams. This shift is creating a more dynamic and innovative work environment, attracting tech professionals who value creativity and autonomy.

The Future of Tech Jobs in Banking

The future of banking is undeniably tech-driven. As banks continue to embrace digital transformation, the demand for tech talent will only grow. Emerging technologies like quantum computing, central bank digital currencies (CBDCs), and advanced AI are expected to create new roles and opportunities in the coming years. Moreover, the convergence of finance and technology is blurring the lines between traditional banking and fintech. This convergence is creating a hybrid ecosystem where banks and fintech companies collaborate to deliver innovative financial solutions. For tech professionals, this means a wealth of opportunities to work on cutting-edge projects and shape the future of finance.

日本語

日本語 한국어

한국어 Tiếng Việt

Tiếng Việt 简体中文

简体中文