COVID đã thúc đẩy nhiều tổ chức tài chính nhanh chóng nâng cấp công nghệ của họ, cho phép họ phục vụ khách hàng một cách hiệu quả trong suốt thời kỳ đại dịch. Theo khảo sát năm 2021 của Strategyand, các lĩnh vực có tiềm năng thuê ngoài trong ngành tài chính cao nhất là thẻ tín dụng, xử lý thanh toán và xử lý các khoản vay tiêu dùng.

Tỷ lệ các ngân hàng sẵn sàng sử dụng dịch vụ thuê ngoài tăng lên khi các ngân hàng nhận ra lợi ích của việc gia công phần mềm.

Theo Guidehouse, 92% các tổ chức tài chính đang sử dụng dịch vụ thuê ngoài báo cáo rằng: họ đã nhận thấy sự cải thiện về hiệu quả và hiệu suất trong hoạt động kinh doanh.

Trong lĩnh vực tài chính – ngân hàng, các công cụ tự động hóa và giải pháp điện toán đám mây trở nên cần thiết để các tổ chức tài chính cạnh tranh hiệu quả. Chỉ bằng cách thực hiện những thay đổi công nghệ như vậy, các ngân hàng mới có thể đáp ứng kỳ vọng ngày càng cao của khách hàng đồng thời kiểm soát rủi ro và duy trì tuân thủ quy định.

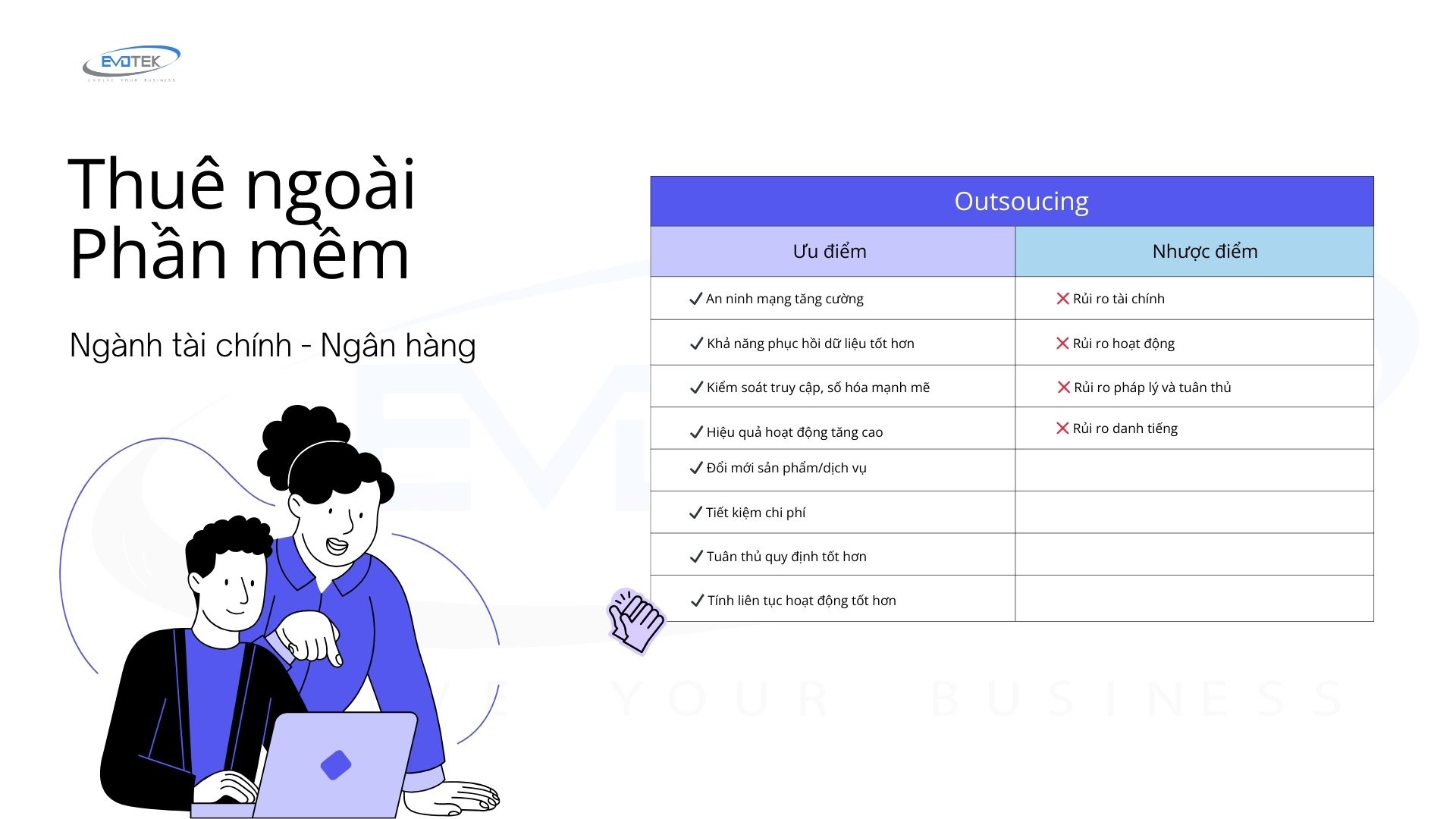

Ưu và nhược điểm của việc Gia công phần mềm trong lĩnh vực tài chính

Mặc dù trước đây, thời gian và chi phí thường là lý do chính khiến các đơn vị tài chính thuê ngoài các chức năng không cốt lõi, nhưng sự gia tăng tốc độ thay đổi công nghệ hiện nay đã thay đổi những gì việc thuê ngoài trong lĩnh vực tài chính đòi hỏi.

Các công ty fintech đã chứng minh được giá trị của mình trong việc cung cấp một số chức năng quan trọng trong các tổ chức tài chính, mang lại lợi ích cả cho tổ chức và khách hàng. Thông qua việc cung cấp các dịch vụ từ lưu trữ dữ liệu đám mây đến ứng dụng ngân hàng cho khách hàng, việc thuê ngoài từ các nhà cung cấp gia công phần mềm có thể mang lại cho các đơn vị tài chính nhiều lợi ích đáng kể như tiếp cận công nghệ mới, tăng tốc phát triển sản phẩm và tiết kiệm chi phí. Tuy nhiên, việc thuê ngoài cũng có thể gặp phải một số rủi ro và thách thức tiềm ẩn cần được xem xét cẩn thận.

Khi đánh giá việc gia công phần mềm trong lĩnh vực tài chính, các tổ chức cần cân nhắc cả lợi ích và rủi ro tiềm ẩn.

Ưu điểm của Outsourcing trong lĩnh vực tài chính

✔️ An ninh mạng tăng cường: Các đối tác gia công dựa trên cloud-based trong lĩnh vực tài chính có thể tăng cường an ninh mạng vượt trội hơn vì họ có khả năng tự động cập nhật các phiên bản và tính năng bảo mật mới nhất để đối phó với các mối đe dọa an ninh mạng. Điều này giúp giảm nguy cơ bị tấn công mạng cho các tổ chức tài chính.

✔️ Khả năng phục hồi dữ liệu tốt hơn: Quan hệ đối tác gia công cho phép các đơn vị tài chính đảm bảo tính liên tục cao trong việc cung cấp dịch vụ trong trường hợp xảy ra thảm họa nhờ các bản sao lưu dữ liệu mạnh mẽ, đảm bảo thời gian hoạt động ít bị gián đoạn hơn.

✔️ Kiểm soát truy cập, số hóa mạnh mẽ: Giúp ngân hàng giảm thiểu rủi ro mất dữ liệu khách hàng và các thông tin nhạy cảm khác do luân chuyển nhân viên thông qua việc áp dụng nhiều lớp xác thực và kiểm soát truy cập nghiêm ngặt hơn.

✔️ Hiệu quả hoạt động tăng cao: Các đối tác gia công dựa trên cloud-based tự động nâng cấp, vá lỗi phần mềm, đồng nghĩa với việc bộ phận CNTT nội bộ của ngân hàng có thể tập trung vào các sáng kiến và quy trình kinh doanh cốt lõi, đồng thời tiết kiệm chi phí nhân sự CNTT.

✔️ Đổi mới sản phẩm/dịch vụ: Phần lớn hoạt động thuê ngoài trong ngân hàng liên quan đến việc hợp tác với các bên thuê ngoài cung cấp các công cụ kỹ thuật tiên tiến, cho phép các tổ chức tài chính phát triển và đổi mới sản phẩm/dịch vụ nhằm phục vụ khách hàng tốt hơn.

✔️ Tiết kiệm chi phí: Thông qua việc thuê ngoài phần cứng, phần mềm và nhân sự CNTT, các tổ chức tài chính có thể cắt giảm chi phí và phân bổ nguồn lực hiệu quả hơn cho các hoạt động kinh doanh cốt lõi của mình.

✔️ Tuân thủ quy định tốt hơn: Các công cụ báo cáo, quản lý tuân thủ do các đối tác thuê ngoài phát triển ngày càng được tích hợp vào hệ thống ngân hàng để giúp họ duy trì sự tuân thủ quy định một cách hiệu quả hơn.

✔️ Tính liên tục hoạt động tốt hơn: Gia công hoạt động trong ngân hàng dẫn đến ít sự gián đoạn hoạt động hơn nhờ các dữ liệu dự phòng được lưu trữ trên các máy chủ cloud do các nhà cung cấp dịch vụ hiện đại quản lý.

Nhược điểm của Outsourcing trong lĩnh vực tài chính

❌ Rủi ro tài chính: Gia công phần mềm ngân hàng có thể gây tổn hại đến tình hình tài chính của ngân hàng nếu nhà cung cấp không đáp ứng được các cam kết về hiệu quả hoạt động được đề cập trong các hợp đồng ràng buộc về mặt pháp lý. Nếu nhà cung cấp bên thứ ba không tuân thủ các nghĩa vụ trong thỏa thuận, điều này có thể dẫn đến tổn thất tài chính đáng kể cho tổ chức tài chính.

❌ Rủi ro hoạt động: Sự cố hệ thống tại nhà cung cấp dịch vụ gia công có thể ảnh hưởng trực tiếp đến hoạt động của tổ chức tài chính, gây gián đoạn trong việc cung cấp dịch vụ cho khách hàng. Vì lý do này, bất kỳ nhà cung cấp bên thứ ba nào được tích hợp vào hệ thống của ngân hàng đều phải được thiết lập và bảo vệ một cách đầy đủ để tránh xảy ra thời gian ngừng hoạt động ngoài dự kiến.

❌ Rủi ro pháp lý và tuân thủ: Một trong những mối lo ngại chính khi thuê ngoài trong ngân hàng là nguy cơ mất quyền kiểm soát dữ liệu. Vì các ngân hàng phải chịu các khoản phạt tài chính nặng nề nếu vi phạm dữ liệu xảy ra, nhu cầu tuân thủ các quy định nghiêm ngặt đã khiến nhiều ngân hàng e ngại việc thuê ngoài hoạt động ngân hàng.

❌ Rủi ro danh tiếng: Lựa chọn đối tác gia công phần mềm sai có thể dẫn đến hậu quả nghiêm trọng, vì bất kỳ sai sót nào của nhà cung cấp đều ảnh hưởng trực tiếp đến danh tiếng của tổ chức tài chính. Thiệt hại có thể xảy ra do báo chí tiêu cực, vi phạm an ninh hoặc vi phạm quy định. Đánh giá nhà cung cấp gia công phần mềm thiếu năng lực có thể dẫn đến trải nghiệm không tốt từ khách hàng, khiến họ thất vọng và gây tổn thất tài chính bất ngờ.

Khi cân nhắc lợi ích và rủi ro của việc thuê ngoài trong lĩnh vực tài chính, nhiều tổ chức nhận thấy rằng việc thuê ngoài giúp cải thiện hiệu quả hoạt động của danh mục cho vay bằng cách đẩy nhanh quá trình cho vay, giảm rủi ro tín dụng và tăng hiệu quả nhờ tích hợp các chức năng. Tương tự, việc phát triển fintech nội bộ có thể dẫn đến sự kém hiệu quả do dư thừa và nỗ lực trùng lặp, thường tạo ra các kho dữ liệu riêng biệt. Vì lý do này, nhiều tổ chức tài chính đã bắt đầu khám phá các mô hình khác nhau để cung cấp dịch vụ ngân hàng, trong đó có việc thuê ngoài.

Để giảm thiểu rủi ro khi thuê ngoài, các ngân hàng cần thực hiện đánh giá đầy đủ về năng lực của nhà cung cấp dịch vụ, đảm bảo có các biện pháp kiểm soát và quy trình quản lý rủi ro phù hợp. Bằng cách cân nhắc cẩn thận lợi ích và rủi ro, và lựa chọn các đối tác gia công phần mềm đáng tin cậy, việc thuê ngoài có thể trở thành một chiến lược hiệu quả để tối ưu hóa hoạt động và tăng lợi thế cạnh tranh cho các tổ chức tài chính.

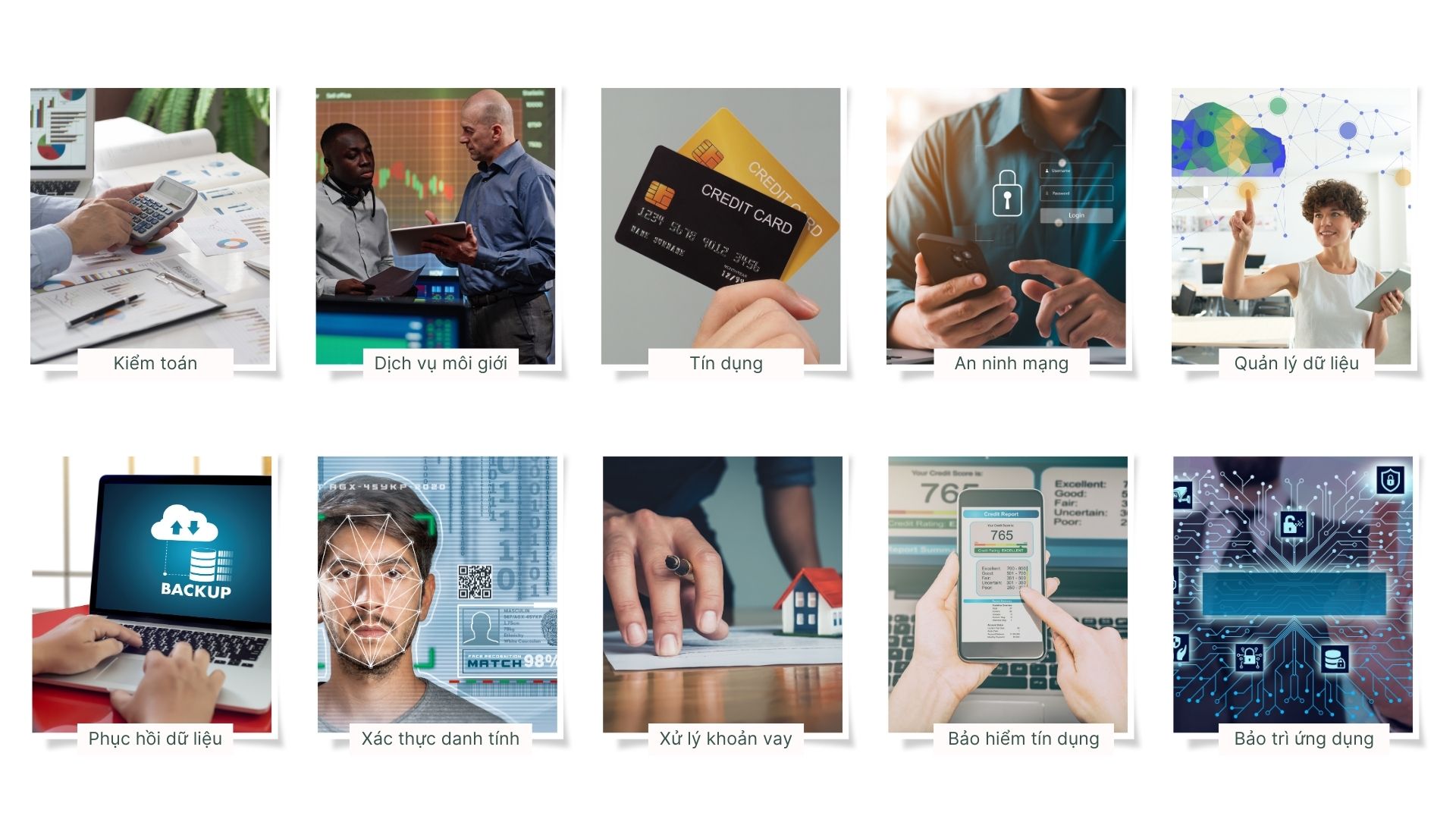

Một số dịch vụ gia công phổ biến trong lĩnh vực tài chính

Việc duy trì kiểm soát là một trong những lý do chính khiến nhiều ngân hàng chưa sẵn sàng từ bỏ hoàn toàn hoạt động nội bộ của mình. Việc lưu giữ dữ liệu tại chỗ thường được coi là an toàn hơn bởi tổ chức tài chính có thể trực tiếp quản lý tất cả các quy trình và máy chủ. Tuy nhiên, mặc dù việc thuê ngoài trong ngân hàng có vẻ tiềm ẩn rủi ro nhưng việc lưu trữ dữ liệu và các quy trình quan trọng khác thực tế có thể an toàn hơn dưới sự kiểm soát của nhà cung cấp bên thứ ba đáng tin cậy và chuyên nghiệp.

Một số dịch vụ thuê ngoài phổ biến trong lĩnh vực tài chính – ngân hàng bao gồm:

- Kiểm toán

- Dịch vụ môi giới và đại lý

- Phát hành và xử lý thẻ tín dụng

- An ninh mạng

- Quản lý và lưu trữ dữ liệu

- Khắc phục thảm họa và phục hồi dữ liệu

- Xác minh và xác thực danh tính khách hàng

- Xử lý và phục vụ các khoản vay

- Cho vay thế chấp và bảo hiểm tín dụng

- Phát triển và bảo trì ứng dụng phần mềm

Mặc dù các ngân hàng lớn có thể quản lý máy chủ và hệ thống nội bộ, nhưng các ngân hàng nhỏ hơn thường bị hạn chế về ngân sách và nhân lực CNTT. Vì lý do này, việc thuê ngoài một số chức năng nhất định cho nhà cung cấp uy tín là giải pháp hiệu quả cho các tổ chức nhỏ hơn. Tuy nhiên, điều này không có nghĩa là các ngân hàng lớn cũng không thể hưởng lợi từ việc thuê ngoài.

Xu hướng mới trong gia công phần mềm lĩnh vực tài chính

Gia công phần mềm trong lĩnh vực tài chính hiện nay đang hướng tới việc cung cấp các dịch vụ quản lý khoản vay đầu cuối nhằm tối ưu hóa quy trình và cải thiện dịch vụ khách hàng cho các tổ chức tài chính. Gia công hiện đại liên quan đến việc tự động hóa các nhiệm vụ trước đây phải thực hiện thủ công như định tuyến luồng công việc, cập nhật dữ liệu theo thời gian thực thay vì theo lô, và cung cấp quyền truy cập thống nhất để quản lý toàn bộ chu trình khoản vay trên một nền tảng duy nhất.

Những đổi mới trong lĩnh vực gia công cũng bao gồm các cấu hình hệ thống linh hoạt, cho phép ngân hàng quản lý và điều chỉnh quy trình kinh doanh nhanh chóng khi điều kiện hoặc quy định thay đổi, giúp duy trì khả năng cạnh tranh.

Ba lĩnh vực chính mà gia công trong ngành tài chính đang diễn ra là:

- Quản lý tài khoản, bao gồm duy trì sổ cái tổng hợp, ghi nhận thanh toán và đóng tài khoản.

- Công cụ chăm sóc khách hàng hỗ trợ ngân hàng bằng cách gọi chào mừng, giới thiệu sản phẩm/dịch vụ và giải quyết khiếu nại của khách hàng.

- Quản lý nợ xấu của khách hàng thông qua các quy trình làm việc được tự động hóa và hệ thống xếp hàng để xử lý các trường hợp phá sản, thu nợ và thu hồi tài sản.

Ngoài ra, nhiều ngân hàng cũng thuê ngoài các dịch vụ quản lý tài sản thế chấp cho các khoản vay và cho thuê ô tô, bao gồm cả quản lý quyền sở hữu, xử lý khi kết thúc hợp đồng thuê và tiếp thị lại phương tiện đã thuê hoặc thu hồi.

Với sự phát triển của công nghệ, xu hướng thuê ngoài trong ngân hàng đang chuyển sang các mô hình gia công phần mềm tiên tiến hơn, tập trung vào tự động hóa, linh hoạt và tích hợp chặt chẽ với các hệ thống của ngân hàng. Điều này giúp các tổ chức tài chính tối ưu hóa chi phí, nâng cao hiệu quả hoạt động và cung cấp trải nghiệm tốt hơn cho khách hàng.

Lợi ích của dịch vụ gia công ứng dụng di động đối với lĩnh vực ngân hàng

Phát triển nhanh ứng dụng ngân hàng di động

Với sự trợ giúp của các dịch vụ gia công phần mềm, các ngân hàng có thể nhanh chóng triển khai các ứng dụng di động mới hoặc nâng cấp các ứng dụng hiện có. Điều này giúp các ngân hàng đáp ứng kịp thời nhu cầu ngày càng cao của khách hàng về các dịch vụ ngân hàng di động, đồng thời tăng khả năng cạnh tranh trên thị trường.

Tiếp cận nguồn lực phát triển phần mềm chuyên nghiệp

Các công ty gia công phần mềm thường có đội ngũ lập trình viên và chuyên gia công nghệ giàu kinh nghiệm, sẽ giúp các ngân hàng tiếp cận nguồn lực phát triển phần mềm chuyên nghiệp mà không cần tuyển dụng và đào tạo nhân sự mới, tiết kiệm chi phí và thời gian.

Tập trung vào lõi kinh doanh

Khi thuê dịch vụ gia công phần mềm, các ngân hàng có thể tập trung vào hoạt động kinh doanh cốt lõi của mình, đồng thời vẫn có được các ứng dụng di động hiện đại và đáp ứng nhu cầu của khách hàng.

Linh hoạt trong việc mở rộng năng lực

Các dịch vụ gia công phần mềm di động cho phép các ngân hàng linh hoạt trong việc mở rộng năng lực phát triển phần mềm khi cần thiết, giúp đáp ứng nhanh nhu cầu thay đổi của thị trường và khách hàng.

Bảo mật và tuân thủ nghiêm ngặt

Các công ty gia công phần mềm đáng tin cậy thường tuân thủ nghiêm ngặt các tiêu chuẩn bảo mật như ISO 27001 và quy định ngành ngân hàng, đảm bảo an toàn thông tin và tuân thủ pháp lý cho các ứng dụng di động.

Tiếp cận công nghệ mới nhất

Các công ty gia công phần mềm thường có kiến thức chuyên môn về các công nghệ mới nhất, giúp các ngân hàng tiếp cận và áp dụng các giải pháp công nghệ tiên tiến nhất cho các ứng dụng di động của mình.

Chi phí hiệu quả

Thuê dịch vụ gia công phần mềm di động thường có chi phí hiệu quả hơn so với việc tuyển dụng và duy trì một đội ngũ phát triển phần mềm nội bộ. Điều này giúp các ngân hàng tiết kiệm chi phí đáng kể.

Trong thời đại số hóa hiện nay, lĩnh vực ngân hàng và tài chính đang chứng kiến một cuộc cách mạng đột phá với sự xuất hiện của các giải pháp phần mềm toàn diện. Evotek đang dẫn đầu trong việc định nghĩa lại hoạt động kinh doanh truyền thống, mang đến những giải pháp phần mềm đột phá cho lĩnh vực tài chính, ngân hàng.

Dịch vụ phát triển phần mềm di động của Evotek tập trung vào việc cung cấp các giải pháp phần mềm đám mây hiện đại, linh hoạt và an toàn cho lĩnh vực ngân hàng và tài chính. Với đội ngũ chuyên gia công nghệ giàu kinh nghiệm và năng lực sáng tạo vượt trội, chúng tôi có thể xây dựng các ứng dụng di động thân thiện với người dùng, đáp ứng đầy đủ các yêu cầu nghiêm ngặt về bảo mật, tuân thủ và hiệu suất cao.

Hãy liên hệ với nhóm của chúng tôi ngay hôm nay và khám phá cách mà các sản phẩm khởi tạo của Evotek có thể biến đổi hoàn toàn hoạt động kinh doanh của bạn. Chúng tôi sẵn sàng cung cấp các giải pháp tùy chỉnh, đáp ứng đúng nhu cầu của bạn và giúp bạn dẫn đầu trong cuộc cạnh tranh gay gắt trên thị trường tài chính ngày nay.

English

English 日本語

日本語 한국어

한국어 简体中文

简体中文