In response to the challenges posed by COVID-19, many financial institutions have expedited their technological upgrades to better serve customers during the pandemic. According to Strategyand‘s 2021 survey, the most promising areas for outsourcing in the financial industry include credit cards, payment processing, and consumer loan processing.

The willingness of banks to utilize outsourcing services has increased as they recognize the advantages it offers.

Guidehouse reports that 92% of financial institutions using outsourcing services have experienced enhancements in efficiency and effectiveness in their business operations.

In the finance and banking sector, automation tools and cloud computing solutions have become indispensable for institutions to remain competitive. These technological advancements are crucial for meeting escalating customer expectations while managing risk and adhering to regulatory requirements.

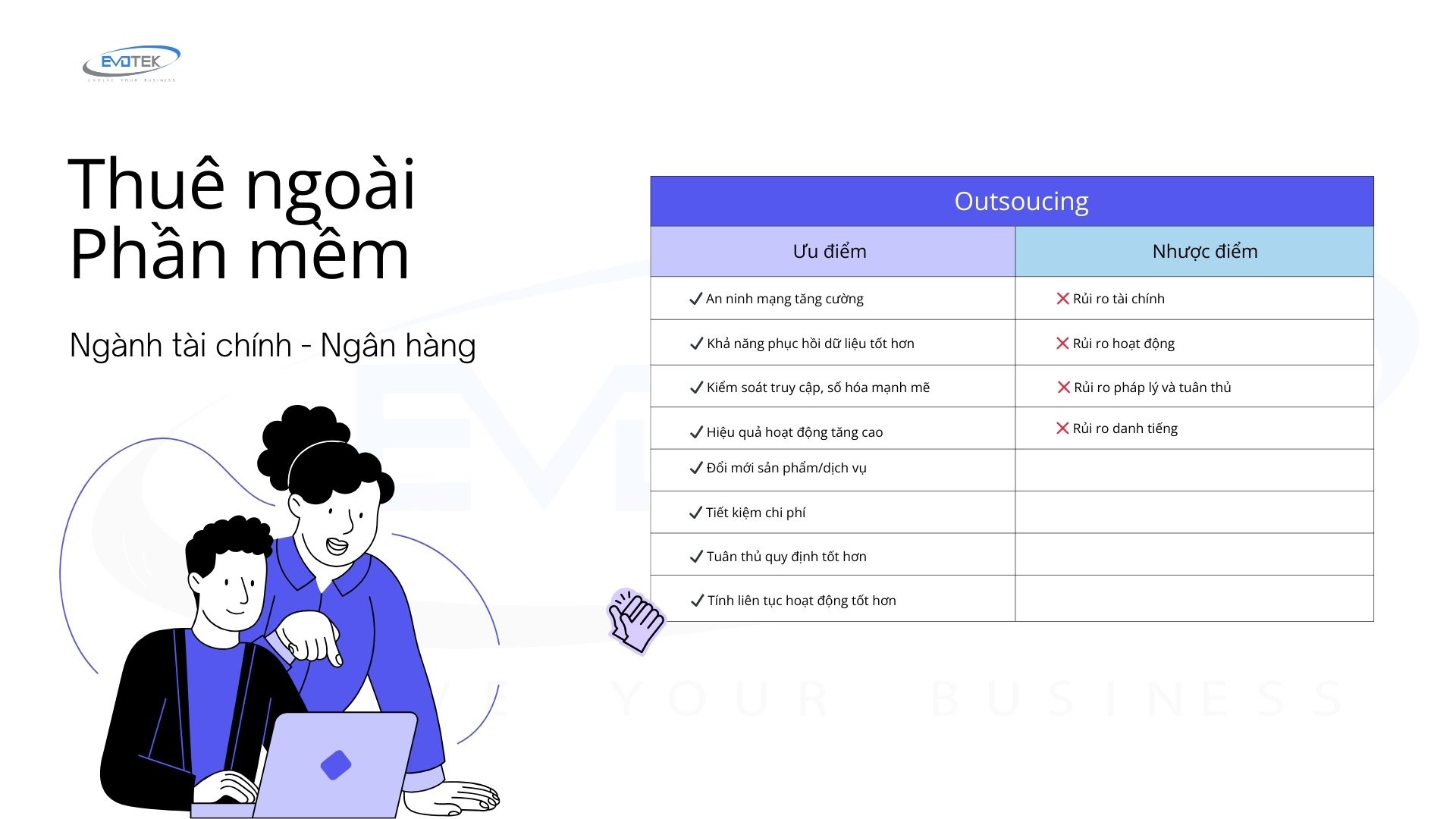

Pros and Cons of Outsourcing in Finance

Traditionally, finance entities outsourced non-core functions primarily to save time and costs. However, the rapid pace of technological advancements in today’s financial landscape has redefined the scope of outsourcing in this demanding sector.

Fintech companies have demonstrated their ability to provide essential functions within financial institutions, benefiting both the organization and its customers. Outsourcing to software providers offers financial units numerous advantages, including access to cutting-edge technology, expedited product development, and cost savings. Nevertheless, outsourcing also presents potential risks and challenges that warrant careful consideration.

When contemplating outsourcing in the financial sector, organizations must weigh both the advantages and potential drawbacks.

Advantages of Outsourcing in the Financial Sector

Enhanced Cybersecurity: Cloud-based outsourcing partners in the financial sector bolster cybersecurity by automatically updating new versions and security features to combat cyber threats. This reduces the risk of cyber attacks for financial institutions.

Improved Data Resilience: Outsourcing partnerships enable financial entities to maintain high service continuity in the face of disasters through robust data backups, ensuring minimal interruption to operations.

Enhanced Access Control and Digitization: Outsourcing helps banks mitigate the risk of data loss and breaches by implementing multiple layers of authentication and strict access controls.

Increased Operational Efficiency: Cloud-based outsourcing partners handle software upgrades and patches, allowing the internal IT department to focus on core business initiatives and processes, thereby reducing IT personnel costs.

Facilitated Product/Service Innovation: Collaborating with outsourcing partners provides access to advanced technical tools, empowering financial institutions to develop and introduce new products/services to better serve customers.

Cost Savings: Outsourcing hardware, software, and IT personnel enables financial institutions to streamline costs and allocate resources more efficiently to their primary business functions.

Enhanced Regulatory Compliance: Outsourcing partners integrate compliance management and reporting tools into banking systems, facilitating effective regulatory adherence.

Improved Operational Continuity: Outsourcing operations in banking ensures smoother operations with redundant data stored on cloud servers managed by modern service providers, minimizing disruptions.

Disadvantages of Outsourcing in the Financial Sector

Financial Risks: Outsourcing banking software carries the risk of financial harm if the provider fails to meet contractual obligations. Non-compliance could lead to significant losses for the financial institution.

Operational Risk: System issues at the outsourcing provider can disrupt financial institution operations, affecting customer service. It’s crucial to ensure third-party vendors are well-prepared to prevent unexpected downtime.

Legal and Compliance Risks: Data control concerns are prominent in banking outsourcing due to strict regulations and hefty penalties for breaches. Many banks hesitate to outsource operations to maintain compliance.

Reputation Risk: Selecting the wrong outsourcing partner can damage the financial institution’s reputation. Negative press, security breaches, or regulatory violations caused by the provider can lead to customer dissatisfaction and financial losses. Judging an outsourcing provider as incompetent can lead to a poor customer experience, leaving them disappointed and causing unexpected financial losses.

While outsourcing can enhance loan portfolio performance by expediting lending processes and reducing credit risk, it’s essential to weigh the risks. Internal fintech development may lead to inefficiencies, prompting many institutions to explore outsourcing models. For this reason, many financial institutions have begun to explore different models for providing banking services, including outsourcing.

To mitigate outsourcing risks, banks should assess providers thoroughly, ensuring robust controls and risk management procedures. By carefully evaluating benefits and risks and selecting reliable partners, outsourcing can optimize operations and bolster competitive advantage for financial institutions.

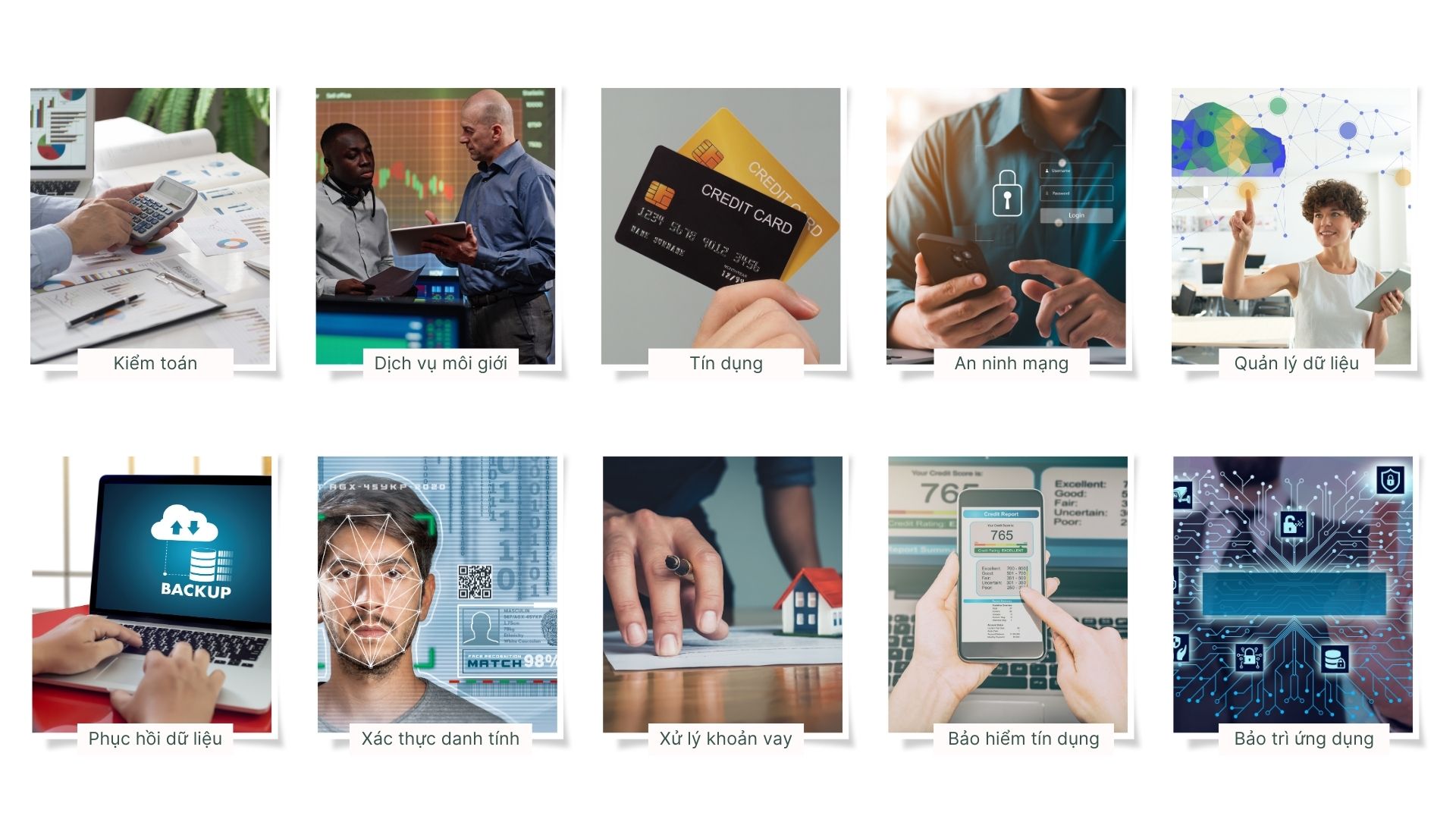

Popular Outsourcing Services in the Financial Sector

Many banks are hesitant to fully relinquish internal operations due to their desire to maintain control. Storing data on-site is often perceived as more secure because the financial institution has direct oversight of all processes and servers. However, contrary to common belief, outsourcing critical processes in banking can offer enhanced security when entrusted to a reputable third-party provider. These providers are known for their reliability and professionalism, often surpassing the security measures achievable internally.

Popular Outsourcing Services in the Finance and Banking Sector:

- Audit

- Brokerage and agent services

- Credit card issuance and processing

- Network Security

- Data management and storage

- Disaster recovery and data retrieval

- Customer identity verification and authentication

- Loan processing and servicing

- Mortgage loans and credit insurance

- Software application development and maintenance

While larger banks may have the resources to manage internal systems, smaller institutions often face constraints in IT budgets and manpower. Outsourcing certain functions to trusted providers proves to be a practical solution for smaller organizations. However, outsourcing can also offer benefits to larger banks.

Emerging Trends in Software Outsourcing in the Financial Sector

The current trend in financial sector outsourcing focuses on delivering comprehensive loan management services to streamline processes and enhance customer service for financial institutions. This modern approach involves automating manual tasks, such as workflow routing and real-time data updates, and providing unified access to manage the entire loan cycle through a single platform.

Innovations in outsourcing now offer flexible system configurations, empowering banks to swiftly adapt business processes in response to changing conditions or regulations, thereby enhancing competitiveness.

The primary areas where outsourcing in the financial industry is prevalent include:

- Account Management: This involves tasks like maintaining general ledgers, processing payments, and closing accounts.

- Customer Support Tools: Outsourced services support banks in various ways, from making welcome calls and introducing products/services to resolving customer complaints.

- Bad Debt Management: Automation is used to handle processes like bankruptcy, debt collection, and asset recovery.

Moreover, many banks opt to outsource collateral management services for auto loans and leases, encompassing tasks such as title management, end-of-lease processing, and vehicle remarketing.

As technology advances, the banking outsourcing trend is transitioning towards more sophisticated software outsourcing models. These models prioritize automation, flexibility, and seamless integration with the bank’s systems, enabling financial institutions to streamline costs, enhance operational efficiency, and deliver superior customer experiences.

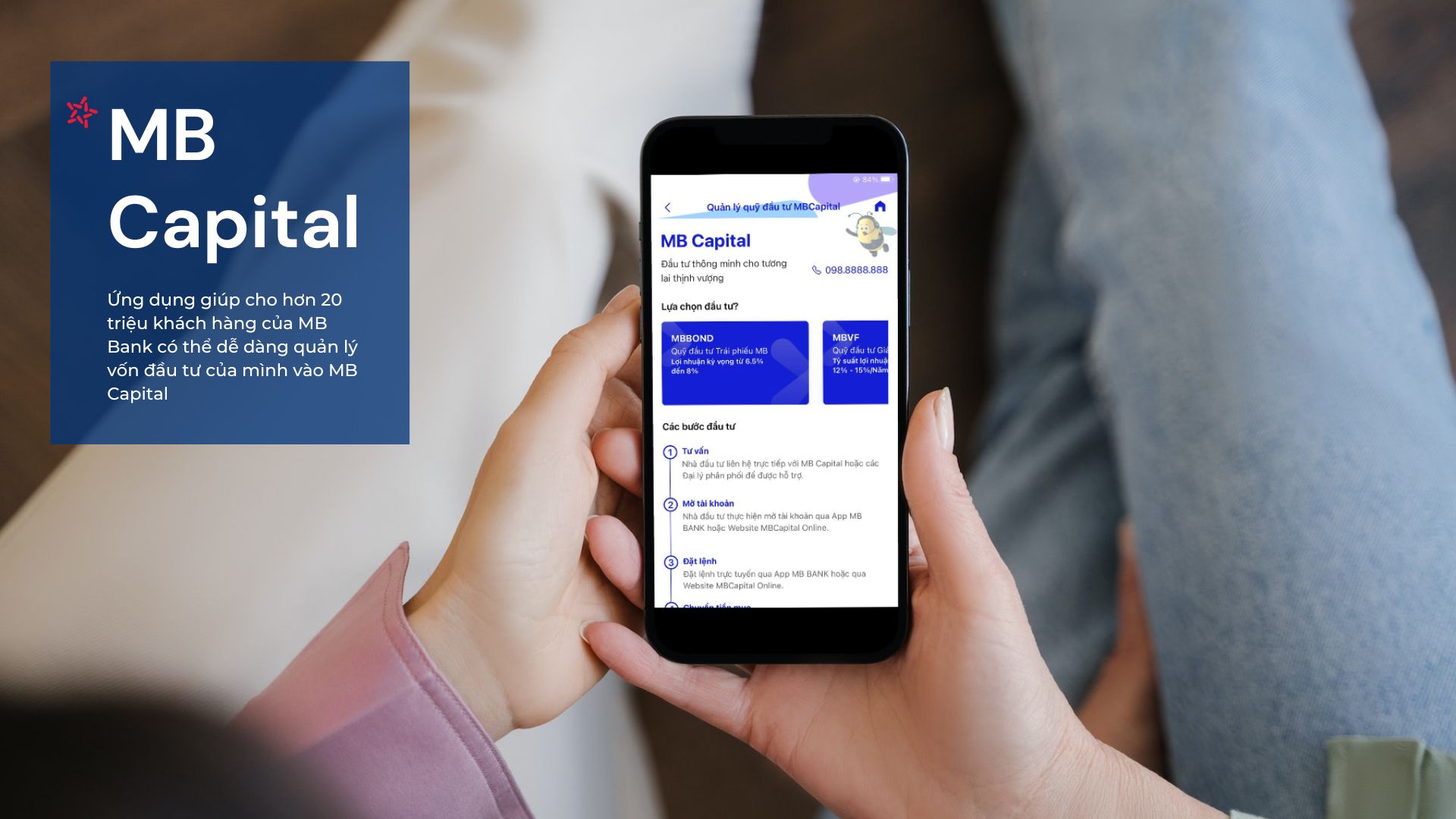

Benefits of Mobile Application Outsourcing Services for the Banking Sector

Rapid Development of Mobile Banking Applications

Outsourcing services empower banks to swiftly deploy new mobile applications or enhance existing ones. This agility enables banks to meet the growing demand for mobile banking services, boosting their competitiveness in the market.

Access to Professional Software Development Resources

Outsourcing companies offer access to skilled programmers and technology experts, sparing banks the need to recruit and train new staff. This saves both time and costs.

Focus on Core Business

By outsourcing software services, banks can concentrate on their core operations while ensuring their mobile applications remain modern and responsive to customer needs.

Flexible Capacity Expansion

Mobile software outsourcing provides banks with flexibility in scaling up development capacity as required, enabling swift responses to evolving market and customer demands.

Stringent Security and Compliance

Reputable outsourcing firms adhere strictly to security standards like ISO 27001 and banking regulations, ensuring information security and legal compliance for mobile applications.

Access to Cutting-Edge Technology

Outsourcing companies stay abreast of the latest technologies, enabling banks to leverage advanced solutions for their mobile applications.

Cost Effectiveness

Outsourcing mobile software development often proves more cost-effective than maintaining an in-house team, resulting in significant cost savings for banks. This helps banks save significant costs.

In today’s digital era, the banking and finance industries are undergoing a significant transformation with the advent of comprehensive software solutions. Evotek leads this revolution by delivering innovative software solutions tailored specifically for the financial and banking sectors.

At Evotek, our focus lies in crafting modern, flexible, and secure cloud software solutions through our mobile software development services. With a team of seasoned technology experts and exceptional creative talent, we specialize in developing user-friendly mobile applications that adhere to stringent security and compliance standards while ensuring high performance.

Get in touch with our team today to explore how Evotek’s pioneering products can revolutionize your business operations. We’re committed to offering customized solutions that precisely align with your requirements, enabling you to stay ahead in today’s fiercely competitive financial markets.