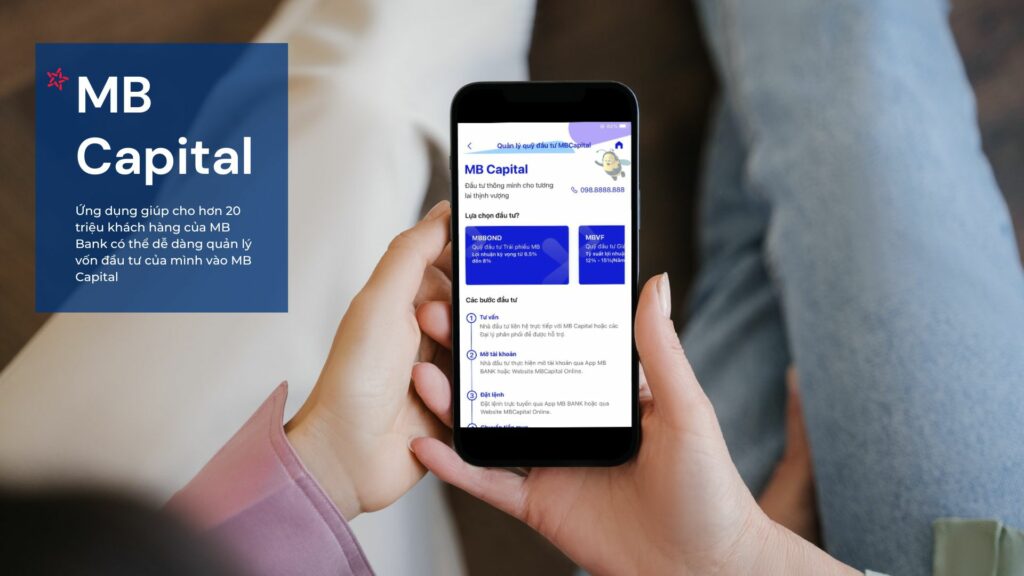

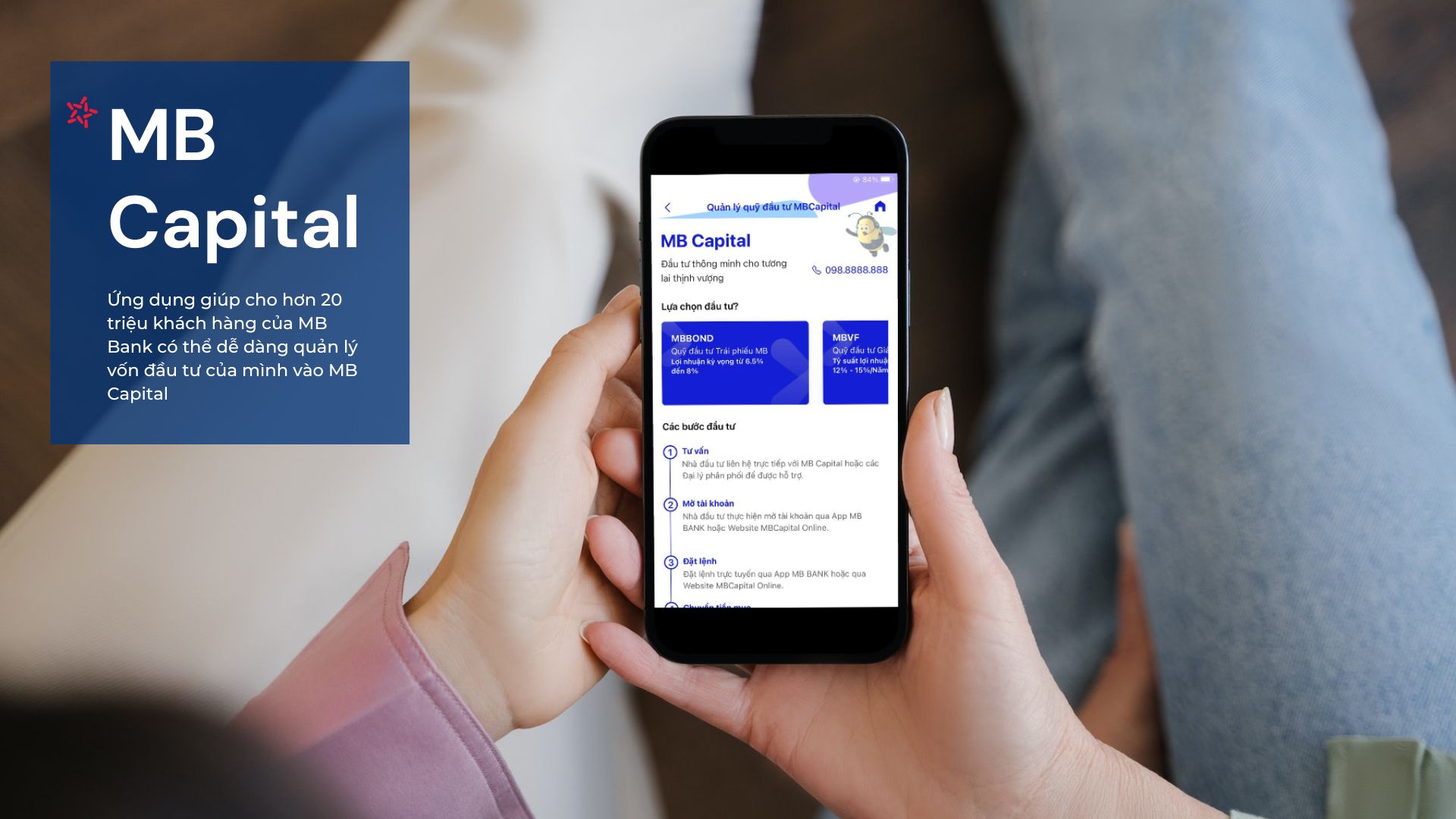

Mobile applications are progressively emerging as crucial and indispensable components for investment funds. They offer convenience and interactivity to engage customers with the fund. Continuous updates of information and market dynamics are essential to keep investors informed and engaged.

1. About the Project

Developing an investment application yields numerous significant advantages for both investment funds and their clients. For investment funds, this application serves not only as a tool for monitoring and managing investment portfolios but also as a conduit for optimizing management processes and facilitating communication with investors. It enables funds to swiftly and flexibly assess the market, offering instant access to market information and new investment opportunities.

Meanwhile, for customers, investment applications provide convenience and flexibility. The ability to track market developments, access fund information, and execute investment orders online grants them complete control and flexibility over their investment portfolios. Daily reporting, real-time market updates, and analytical tools empower customers to make informed and agile decisions, culminating in a comprehensive and effective investment experience.

2. Features of the Investment Fund Application

- Empowers users with flexible control and management of personal accounts, from viewing account details to investment management and fund withdrawal.

- Flexible and convenient online transaction capabilities.

- Provides real-time updates on financial news and trends for informed investment decisions.

- Swift registration processes and transaction execution in just a few clicks, saving significant user time.

- Enables trading and investment monitoring from anywhere, even during periods of social distancing.

- High-security features to ensure the safety of user financial information and transactions.

- Offers detailed information on investment types and advisory support for making intelligent financial transactions.

3. Technical Challenges

- Increasingly sophisticated cyber threats demanding robust security mechanisms within the application to prevent unauthorized access and ensure user data safety.

- Ensuring the product operates seamlessly across various devices and platforms (mobile phones, tablets, iOS, and Android operating systems). Ensuring compatibility and consistent user experience across diverse platforms pose a challenge for the Evotek development team.

- Requiring smooth and stable application performance even with a large number of concurrent users. This necessitates performance optimization and meticulous testing to ensure stable app functioning without disruptions.

- Ensuring a user-friendly User Experience (UX) and User Interface (UI) design, focusing on creating an intuitive and easy-to-use interface.

- Adhering to financial and banking regulations, security policies, and legal standards concerning financial applications.

4. Evotek’s solution

- Applying the microservices architectural model helps create small, flexible services that can easily integrate with other systems effectively.

- Apply edge computing to process data right at the origin, helping to reduce latency and increase processing speed.

- Use automated testing tools to ensure application quality and minimize errors.

- Use monitoring tools to track and detect errors, thereby quickly repairing and improving the system.

- Upgrade infrastructure with new technologies such as virtual servers, SSD storage, 5G network, to improve system performance and capacity.

- Use smart UI/UX design to improve user experience, reducing time and effort when using the application.

5. Results

- In 2022, the client successfully achieved 157% of the annual plan.

- The number of customers increased fivefold compared to the beginning of the year.